Instruments to be in English. General directions as to cancellations of adhesive stamps.

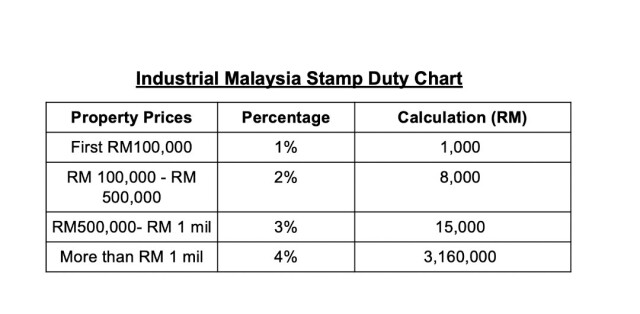

Proposed Ad Valorem Stamp Duty To Be Paid When Contract Signed Publication By Hhq Law Firm In Kl Malaysia

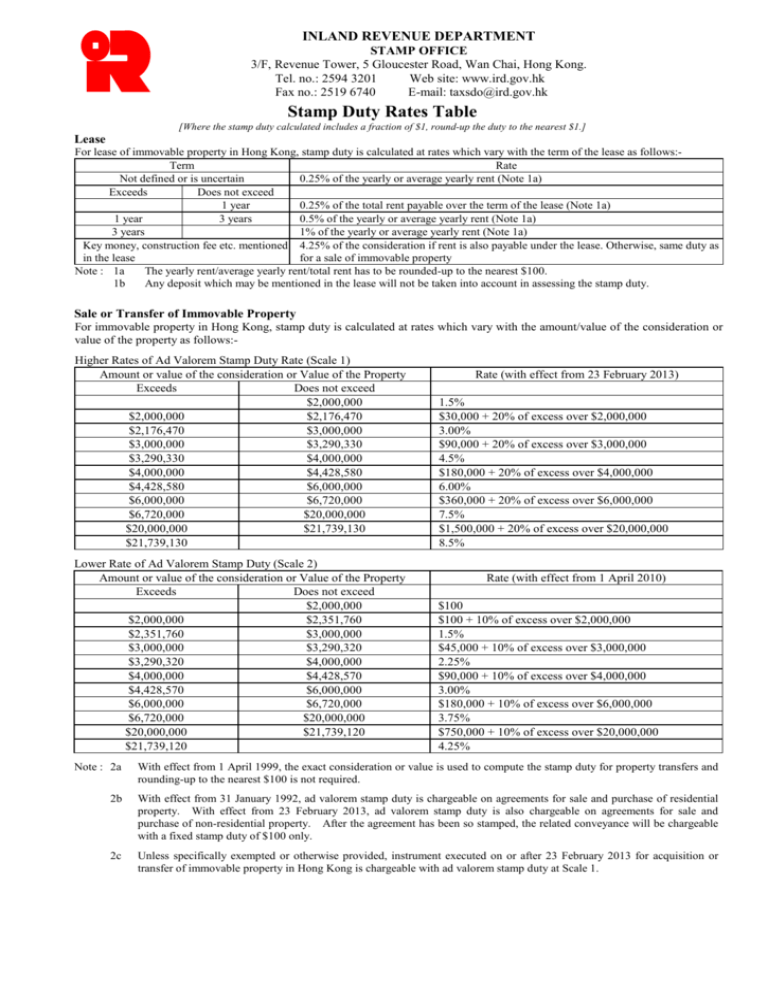

Ad Valorem Stamp Duty AVD at higher rates Scale 1 Ad Valorem Stamp Duty AVD at lower rates Scale 2 Read about the relevant stamp duty rates.

. Stamp duty pula mempunyai 2 kategori iaitu kadar tetap dan Ad Valorem. OFFICE OF THE COMMISSIONER GF OCOM Building. Mode of calculating ad valorem duty in certain cases.

What are the rates including marginal relief at Scale 1. Charter-parties first executed outside Nigeria without being duly stamped may be stamped with an adhesive stamp within 10 days after it is first received in Nigeria and before it has been. B Government contract ie.

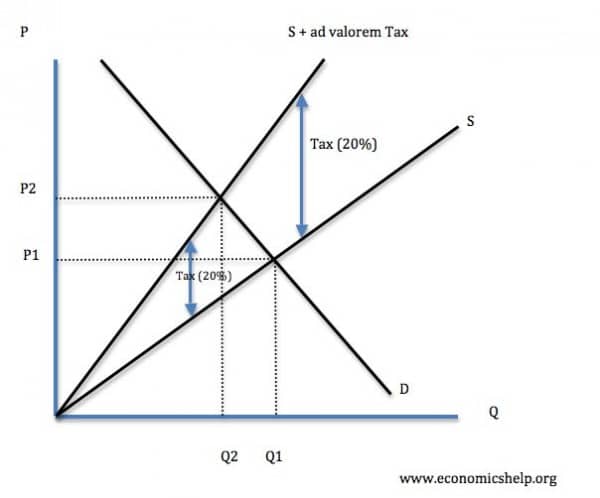

Ad Valorem Tax Landed Cost. STAMP DUTY ACT CHAPTER 480 Revised Edition 2012 2010 Published by the National Council for Law Reporting with the Authority of the Attorney-General. - 1 Where an instrument is chargeable with ad valorem duty in respect of any money expressed in any currency other than of India such duty shall be calculated on the value of such money in the currency of India according to the current rate of exchange on the day of the date of the.

Deed of ReleaseSurrenderDischarge Without Stamp Duty Certificate for MortgageDebenture Ad Valorem. In an interview with Bloomberg Ye Liu Shuyi convener of the Executive Council and chairman of the New Democracy Party said that exemption from double stamp duty for Chinese home buyers could be considered referring to mainland professionals who have been demanding that they be exempted from double stamp duty before obtaining the right of abode. Conversion of amount expressed in foreign currencies.

Part 1 of Scale 1 Applicable to instruments of residential property executed on or after 5 November 2016. For stamp duty purposes a PASP is a chargeable agreement for sale. If you are ready please first select the type of document to enter the relevant Stamp Duty Computation input page.

Kadar Tetap adalah dimana harganya sudah ditetapkan manakala Ad Valorem pula adalah harga yang boleh berubah bergantung pada setiap nilai transaksi dokumen. X 12 Rate of VAT Total Duties of Taxes Customs Duty Ad Valorem Tax VAT IPF. Between Federal State Government of Malaysia or State local authority and service providers.

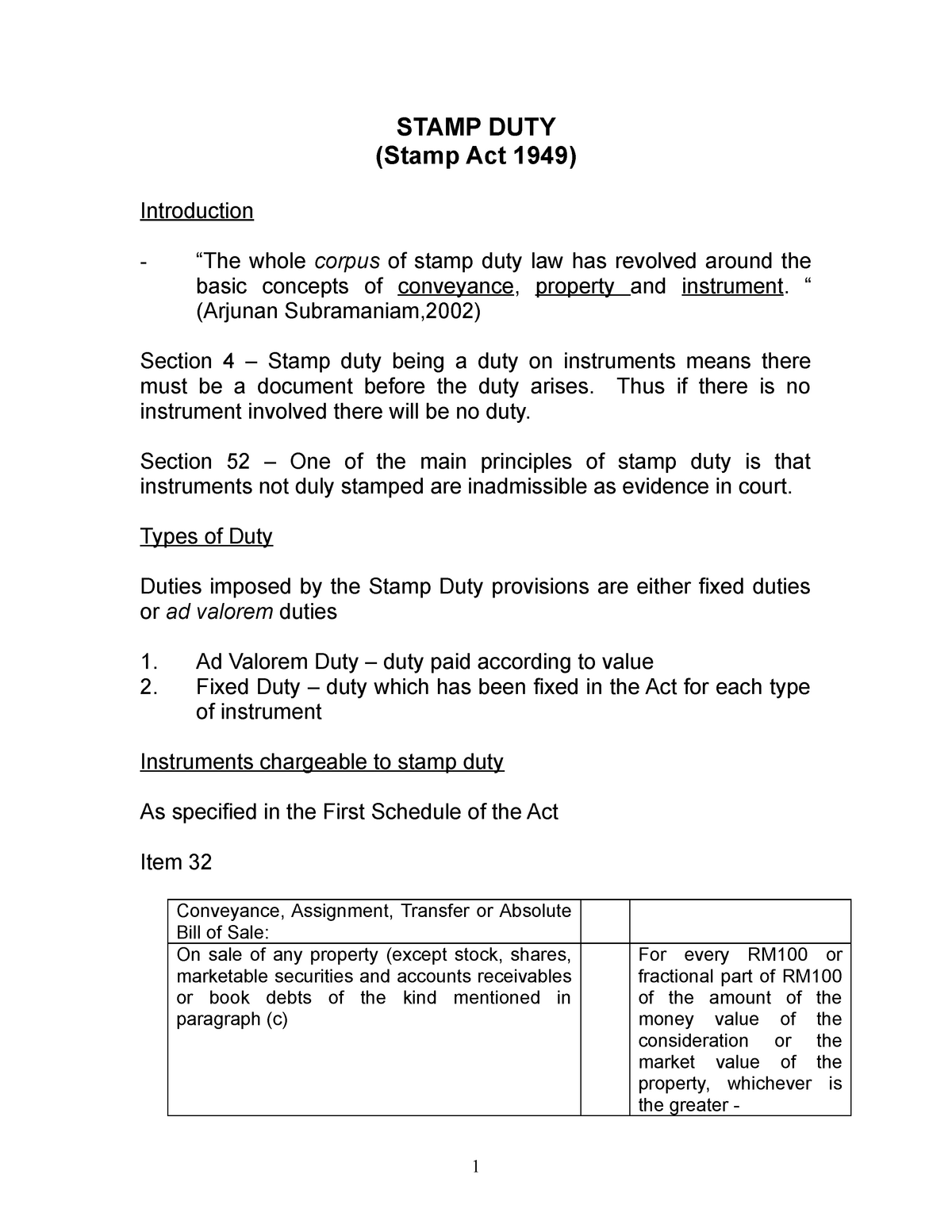

Stamp duty is a tax that is levied on single property purchases or documents including historically the majority of legal documents such as cheques receipts military commissions marriage licences and land transactionsA physical revenue stamp had to be attached to or impressed upon the document to show that stamp duty had been paid before the document. Current version as at 31 Aug 2022. Schedule II Repealed 1 THE STAMP ACT 1899 Act II of 1899 27 January 1899.

Lease Agreement TenancyMachinery for transactions above 21 Years. Use of Adhesive Stamps 13. Agreement for sale chargeable with ad valorem stamp duty.

For claiming for charging ad valorem stamp duty at lower rates Scale 2 it is the date of the agreement for sale or the date of first agreement if there is more than one agreement the if there is no agreement for sale the date of or conveyance on sale deed of gift. Subject to ad valorem duty they are required to be stamped within 30 days from firstexecution or first receipt in Nigeria if executed outside Nigeria. Select All Clear All.

Ad valorem rate of 01. Value Added Tax Value Added Tax Base. THIRD SCHEDULE Persons liable to pay stamp duty FOURTH SCHEDULE Adjudication fees FIFTH SCHEDULE Valuation fees Legislative History Abbreviations Comparative Table.

CDS Fixed Amount of P26500. The basis for computation of stamp duty can be determined by the State Legislature and it may be on the basis of the market value of the property transferred or at a fixed amount. Nominal Duty Document Relating to Ad Valorem Duty Document For subsequent contract or agreement effecting the same sale of the same property where duty has been paid based on the amount or value of consideration paid such as fresh Sale and Purchase.

In connection with the transactions referred to below we hereby apply on behalf of the Acquiring Company for exemption from transfer duty under Section 77 Finance Act 1986. Prior to 18 June 2015 motor vehicles included in a business purchase may be exempt from stamp duty where the value of the motor vehicles has been included in the purchase price of the business and ad valorem duty has been paid on the conveyance of the business. The measure of charging stamp duty may be fixed or ad-valorem which is to be determined by the Legislature.

Pay double stamp duty DSD while the ad valorem stamp duty rate of the second property is increased to a flat 15 AVD and mainland tourists need to pay 30 stamp duty on the property price in disguise. Stamp Duties Act 1929. Sale and Purchase of Immovable Property Sellers Stamp Duty 5-10 mins LeaseTenancy.

Customs Documentary Stamp CDS Import Processing Fee IPF D. In the first half of the year the three major residential hot tax revenue was 366 billion down 32 from the same period last year. If a transaction can be effected without creating an instrument of transfer no duty is payable.

Ad valorem stamp duty AVD - Scale 1 and Scale 2. Subsequent levels Up to RM50. Where an instrument is chargeable with ad valorem duty in respect of any money expressed in any currency other than that of 83 Pakistan.

Stamp-Duty on Instruments. Stamp duty is chargeable on instruments and not on transactions. In the case of an instrument executed on or after 16th January 2014 where the application for relief is made before the execution of the instrument unless the Commissioner otherwise allows the instrument is executed within 4 months after any indication given by the Commissioner that ad valorem stamp duty will not be chargeable on the.

Schedule I Updated Stamp Act 1899 Hhhh The Stamp Act 1899 Act Ii Of 1899 Schedule I Stamp Duty Studocu

Ad Valorem Stamp Duty Damian S L Yeo L C Goh

What You Must Know For Stamp Duty Tax And Exemptions When Buying Industrial Properties In Malaysia Industrial Malaysia

Stamp Duty Notes Statutory Valuation For Auction Rating Wayleave Easement Stamp Duty Stamp Studocu

Hong Kong Stamp Duty Your Complete Guide 2020

Hong Kong Stamp Duty Your Complete Guide 2020

Hong Kong Stamp Duty Your Complete Guide 2020

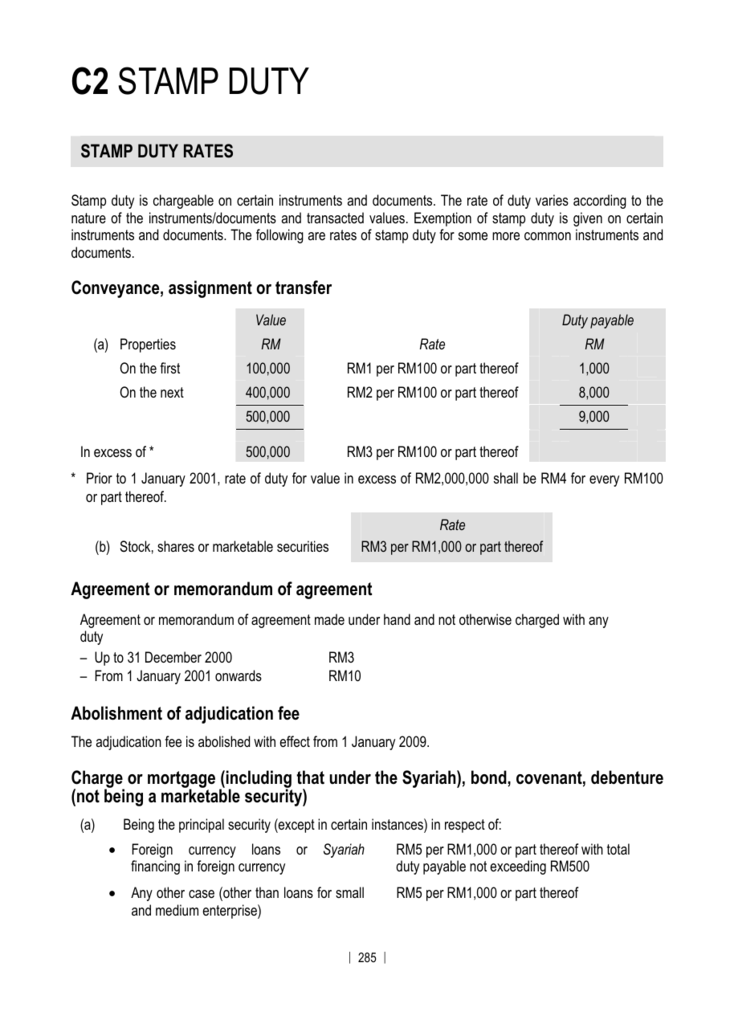

C2 Stamp Duty The Malaysian Institute Of Certified Public

Changes Proposed To Stamp Act In Malaysia Conventus Law

Hong Kong Stamp Duty Your Complete Guide 2020

Stamp Duty Valuation And Property Management Department Portal

Stamp Duty Share Transfer Difference On B S Notes Deed Of Gift And Discuss On Property Transfer Etc Hk Account Q A